- Enterprise OnChain

- Posts

- Blockchain Performance: Why Ethereum's "Slowness" Is Actually Its Strength

Blockchain Performance: Why Ethereum's "Slowness" Is Actually Its Strength

In the race for blockchain supremacy, "speed" has become the metric du jour.

New chains and Layer 2 solutions proudly tout their transactions per second (TPS), sub-second confirmation times, and microscopic fees. Meanwhile, Ethereum's mainnet—the original programmable blockchain—continues at its measured pace of 12-second block times and fees that can sometimes reach dollars rather than fractions of cents.

But what if Ethereum's apparent "slowness" isn't a bug but a feature?

The Need for Speed... Or Is There?

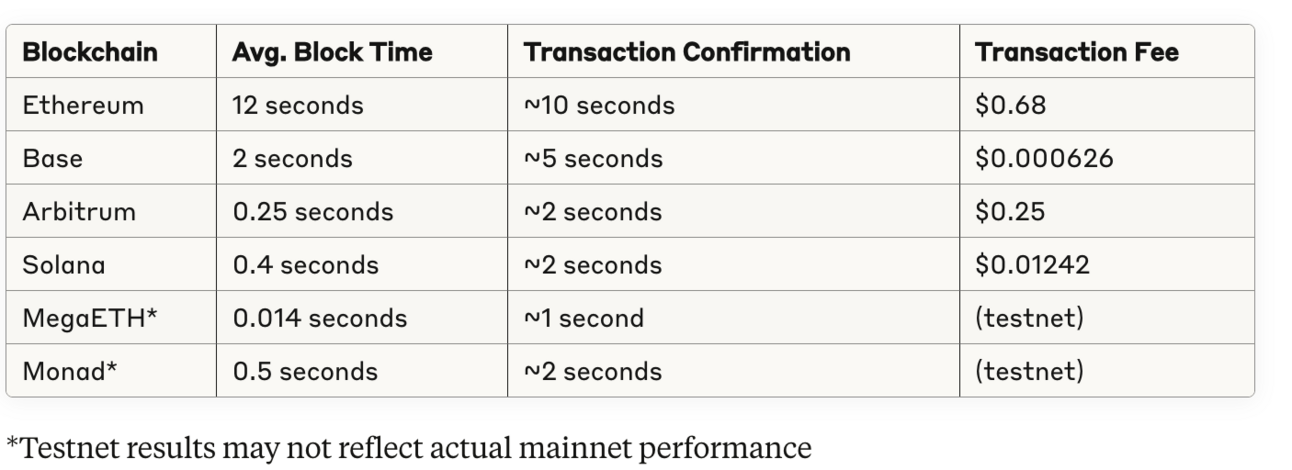

Recent performance tests by Etherscan across multiple blockchains tell an interesting story:

The numbers are clear:

Ethereum is substantially slower and more expensive than alternatives.

Base is approximately 1,086 times cheaper per transaction.

Arbitrum and Solana confirm transactions up to 5 times faster.

MegaETH is an L2 that’s the fastest and cheapest.

But these raw numbers tell only part of the story.

The Decentralization Trade-Off

Ethereum's relatively slower performance isn't the result of outdated technology or inefficient design—it's a deliberate choice. While newer blockchains optimize for speed and cost, Ethereum prioritizes something else: true decentralization.

This commitment to decentralization manifests in several ways:

Higher node requirements: Ethereum maintains accessibility for individual validators rather than requiring industrial-grade hardware.

Greater validator diversity: Ethereum's consensus mechanism prioritizes widespread participation over concentrated efficiency.

Security-first approach: Ethereum's cautious approach to protocol upgrades puts stability and security above rapid iteration.

In essence, Ethereum moves more cautiously because it's carrying something more valuable: the largest decentralized financial ecosystem in the world, currently securing hundreds of billions of dollars in value.

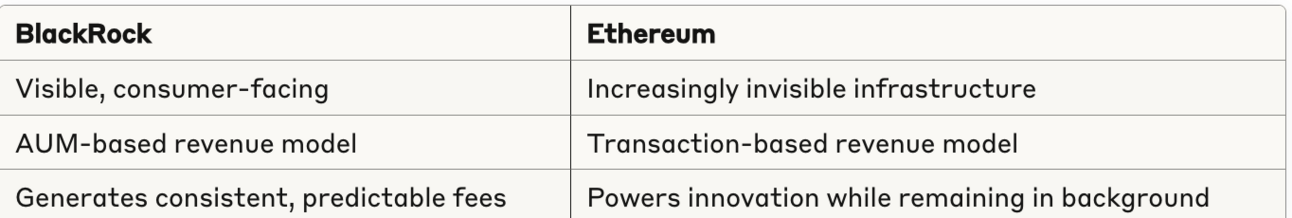

Let’s flip blockchain on its head, it charges only when a transaction is made, compared to say a BlackRock.

BlackRock vs. Ethereum Business Models

Check out my post on this here

The scale difference is staggering: If BlackRock were to accumulate $100 billion on Ethereum (entirely feasible given their $10+ trillion global AUM):

BlackRock would earn approximately $500 million annually at 0.5% fees

Ethereum would need 909 million transactions at $0.55 each to match this revenue

This raises a provocative question: Should blockchains change their business model? Hmm, I don’t think so.

Should it strive to be the "invisible infrastructure" that enables value creation, rather than attempting to extract value like traditional finance?

Perhaps we're measuring success with the wrong metrics.

What if Ethereum's actual value isn't in how much value it captures, but in how much value it enables others to create? This perspective shifts our understanding of Ethereum from a profit-generating entity to a public good infrastructure that maximizes collective benefit rather than extracting maximum fees.

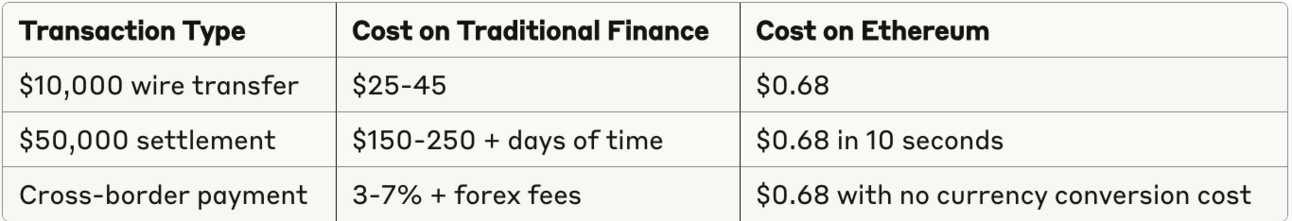

High-Value Transactions: Where Ethereum Shines

For many users, especially those in DeFi, paying a $0.68 fee on a $10,000 transaction represents just 0.0068% of the transaction value—vastly cheaper than traditional finance alternatives, which might charge 1-3% or more.

Consider these comparisons:

For high-value transactions, Ethereum's fees become vanishingly small as a percentage of the transaction amount. Moreover, these transactions settle in minutes rather than days, with no intermediaries or counterparty risk beyond the protocol itself.

The Multi-Chain Reality: Different Tools for Different Jobs

The blockchain ecosystem is evolving toward specialization rather than a winner-takes-all model. We're witnessing the emergence of a multi-chain world where:

Ethereum L1 serves as the settlement layer for high-value transactions, complex DeFi operations, and critical financial infrastructure.

Layer 2 solutions (Base, Arbitrum, Optimism) handle medium-value transactions with significant security requirements but greater fee sensitivity.

Alternative L1s like Solana excel at high-frequency, low-value transactions where immediate finality with reasonable security is sufficient.

Experimental networks like Monad and MegaETH push the boundaries of what's possible in terms of raw performance.

Rather than viewing these as competitors, think of them as complementary components in an increasingly sophisticated financial ecosystem.

Beyond Raw Speed: What Really Matters

When evaluating blockchain performance, we should look beyond simplistic metrics like TPS and instead consider:

Time-to-finality: How long until your transaction is irreversible?

Security guarantees: What's the cost of attacking the network?

Censorship resistance: Can your transaction be blocked by centralized actors?

Developer ecosystem: How robust is the tooling and support?

Liquidity depth: How efficiently can assets be exchanged?

Interoperability: How well does the network connect with others?

On many of these more nuanced metrics, Ethereum continues to lead—even if its raw speed numbers don't match the latest contenders.

Looking Forward: The Best of Both Worlds

Ethereum's upcoming upgrades, such as the Pectra and sharding implementations, aim to increase throughput without compromising its core principles. So enterprises are building on L1 Ethereum right now, knowing that tech changes will give them the best of all worlds in the future. (Security, Speed, and cost)

Meanwhile, the rollup-centric roadmap continues to mature, with Layer 2 solutions inheriting Ethereum's security while operating at much higher speeds.

The future isn't about choosing between speed and security—it's about building systems that provide appropriate levels of both for different use cases.

Choose the Right Chain for the Right Task

As blockchain technology matures, we're moving beyond the simplistic "my chain is faster than your chain" debates toward a more nuanced understanding of blockchain performance.

For moving millions between institutions, securing valuable digital assets, or executing complex financial operations, Ethereum's "slowness" represents patience and prudence (exactly what you want when significant value is at stake)

For everyday payments, gaming microtransactions, or social media interactions, the faster alternatives make perfect sense.

The blockchain that wins won't necessarily be the fastest or the cheapest—it will be the one that best serves its intended purpose while maintaining the right balance of speed, security, and decentralization for its users.

In this more mature perspective, Ethereum's measured pace isn't a limitation but a reflection of its priorities: building financial infrastructure that's not just fast, but fundamentally robust.

Reply